Agriculture is one of the economic sectors in which digitalization has triggered a new technical revolution.

The autonomous agricultural machines designed for the monoculture landscapes of industrial agriculture, with their specialization on individual crops and high acquisition, operating and maintenance costs, as well as the associated handling effort, are not an option for medium-sized farms regarding their focus on vegetable cultivation and organic farming.

biogriculture's patent-pending crop zone detection method is technically very simple and at the same time independent of crop species, weather and light conditions. Due to its small size, the robot developed by biogriculture can travel between planting rows and autonomously adapt to different row and planting distances using the actuator-controlled arm. This also enables its use in biodynamic cultivation such as permaculture and so-called spot farming where crop rotations are taken into account. By using industrial standard components, the estimated manufacturing costs are below 1000 EUR per unit. This makes it the only solution available on the market that enables even medium-sized farms to get started with autonomous weed control.

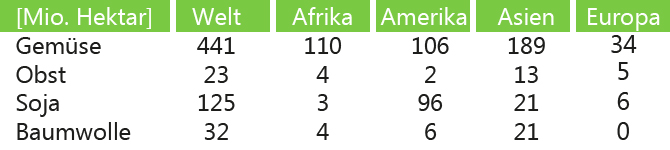

Worldwide, the Food and Agriculture Organization of the United Nations shows ~620 million hectares of cultivated area for vegetables, bush fruits, soybeans and cotton that are suitable for MRV-10 use - with vegetables accounting for 71%.

In 2020, the market volume for agricultural technology in Germany (worldwide) amounted to about EUR 6.15 billion (EUR 107 billion). For 2023, the auditing firm Earnst and Young expects sales of USD 2.5 billion for autonomously operating machines and robots, which will increase to USD 10 billion by 2028. Due to the low vertical integration, direct sales with centralized maintenance unit and the resulting economies of scale in manufacturing and sales, biogriculture can grow rapidly (A sales volume of 100,000 robots and a revenue of EUR 250 million would correspond to a market share for robotics of 2.5% by revenue and 1% of the suitable area in Europe / USA.

With a higher investment volume, a significant leverage effect can be achieved compared to the current planning, if prototyping or market launch can be accelerated accordingly. In the unfilled market for agricultural robotics, accelerating the market entry can result in a competitive advantage that is unassailable over a longer period of time. Additional earnings potential can be secured by a broader customer base in conjunction with the instruments described for sustainable customer loyalty.

Based on the patents registered by biogriculture, there are three scenarios for market entry.

Direct marketing: By using standard components, production can be easily outsourced and is easily scalable. Due to small size, weight and low price level, the processes for sales, distribution and maintenance can be set up in a central direct marketing platform. Current subsidy programs enable farms to reduce their investment costs by 20-40% and support sales. Due to the low investment costs per robot and the reuse of the crop zone markers, it is expected that additional units will be purchased after a successful field application. In addition, there is maintenance and sale of wear parts.

Leasing/rental: Due to the low manufacturing costs and assuming gradual growth, a leasing or rental concept with low additional capital requirements is also possible for a market entry. Compared to direct marketing, leasing and rental models once again reduce investment costs for farmers and increase customer loyalty over time.

Cooperation, licensing, sale of patent rights: Cooperation and licensing additionally increase the sales and service network of the partners and the customer loyalty to their products.